WHICH 8 NOS FACTORS IMPACT ON CHOICE FOR LOANS

Gold loans vs personal loans: factors that affect your choice

Major economies are in turmoil causing people to lose their jobs. The shutting down of major banks is now resulting in contempt for financial services too. Many feel forced to take loans to pay for their expenses or repay their loans. Many borrowers now wonder what kind of loan would suit them best considering how they can choose between gold loans and Personal loan.

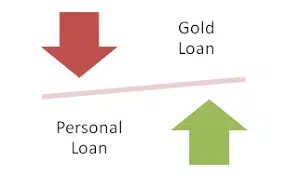

Gold loans and personal loans are two types of loans that individuals can take out from banks or other financial institutions. While both types of loans can provide financial assistance, they differ in several ways.

A gold loan is a secured loan that is obtained by pledging gold ornaments or jewelry as collateral. The loan amount is determined by the value of the gold. Gold loans usually have lower interest rates than personal loans because they are secured by collateral. If the borrower defaults on the loan, the lender can sell the gold to recover the loan amount.

Ultimately, the choice between a gold loan and a personal loan depends on the individual’s financial situation and requirements. If you have gold jewelry or ornaments that you can pledge as collateral, a gold loan might be a better option. However, if you don’t have collateral or have a good credit score, a personal loan might be more suitable.

On the other hand, a personal loan is an unsecured loan that is granted based on the borrower’s creditworthiness and income. Personal loans do not require collateral, but they have higher interest rates than gold loans. The borrower’s credit score and financial history are crucial factors that determine the loan amount and interest rate.

HOW 8 FACTORS AFFECT THE CHOICE FOR LOAN

In summary, the main differences between gold loans and personal loans are:

- Collateral: Gold loans are secured loans, while personal loans are unsecured loans.

- Interest rates: Gold loans have lower interest rates than personal loans because they are secured by collateral.

- Eligibility: Gold loans are more accessible to individuals with poor credit scores, while personal loans require a good credit score.

- Loan amount: The loan amount for gold loans is determined by the value of the gold, while personal loans depend on the borrower’s credit score and financial history.

- Interest rates: Interest rates are an essential factor when choosing between gold loans and personal loans. Gold loans typically have lower interest rates than personal loans because they are secured by collateral. However, interest rates can vary between lenders, so it’s essential to compare the rates offered by different lenders.

- Loan amount: The loan amount you require is another crucial factor to consider. Gold loans are suitable for smaller amounts because the loan amount is determined by the value of the gold. On the other hand, personal loans can offer higher loan amounts, depending on your credit score and financial history.

- Credit score: Your credit score is an essential factor in determining the type of loan you qualify for. If you have a poor credit score, you may find it challenging to qualify for a personal loan. In such cases, a gold loan may be a more accessible option since it does not depend on your credit score.

- Repayment terms: Repayment terms can vary between lenders, so it’s essential to understand the terms before taking out a loan. Gold loans typically have shorter repayment periods than personal loans. If you require a more extended repayment period, a personal loan may be a better option.

FAQs

- Q: What is the maximum loan amount I can get with a gold loan? A: The maximum loan amount you can get with a gold loan depends on the value of the gold you pledge as collateral. Most lenders offer up to 75-80% of the gold’s value as a loan.

- Q: What is the interest rate for gold loans and personal loans? A: The interest rate for gold loans and personal loans can vary between lenders. However, gold loans usually have lower interest rates than personal loans because they are secured by collateral. The interest rate for personal loans is typically higher since they are unsecured loans.

- Q: Can I get a gold loan if I have a poor credit score? A: Yes, you can get a gold loan even if you have a poor credit score. Since gold loans are secured loans, the lender is less concerned about your credit score.

- Q: Can I get a personal loan without a credit score? A: It’s challenging to get a personal loan without a credit score since lenders rely on credit scores to assess a borrower’s creditworthiness. If you don’t have a credit score, you may need to provide other documentation, such as income statements or bank statements, to qualify for a personal loan.

In summary, the loan amount, interest rates, credit score, and repayment terms are essential factors to consider when choosing between gold loans and personal loans. It’s important to compare different lenders and loan options to make an informed decision based on your financial situation and requirements.