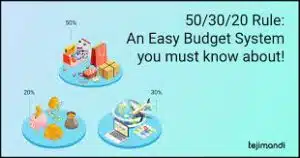

What is the 50/30/20 Rule of Budgeting?

According to the 50/30/20 rule, one should set aside 20% of their income for savings and debt repayment while assigning the remaining 80% to savings and discretionary spending. While the “discretionary spending” category covers costs like entertainment, eating out, and shopping, the “necessities” category includes costs like housing, transportation, and food. Expenses like retirement planning, student loan repayment, and emergency fund creation fall under the “savings and debt reduction” category. The goal of the rule is to give people a clear structure for handling their finances and ensuring that they are living within their means.

The 50/30/20 rule provides several benefits as a personal finance guideline:

- It promotes balance: The rule encourages individuals to allocate a balanced portion of their income towards necessities, discretionary spending and savings/debt repayment.

- It helps in budgeting: By dividing income into three categories, it helps individuals to create a budget and stick to it.

- It helps to prioritize expenses: The rule helps individuals to prioritize their expenses by identifying which expenses are essential and which are not.

- It helps to save: By allocating 20% of income towards savings and debt repayment, the rule helps individuals to build an emergency fund and pay off debt, which can lead to financial stability in the long term.

- It’s easy to follow: The rule is simple and easy to understand, making it accessible to people of all financial backgrounds.

It’s important to remember that the 50/30/20 rule is a guideline and not a hard and fast rule, your individual circumstances may vary, and you should adjust the rule accordingly to fit your lifestyle and financial goals.

The 50/30/20 rule has some potential disadvantages when it comes to budgeting:

- It may not be realistic for everyone: Depending on where a person lives, 50% of their income may not be enough to cover necessities such as housing and transportation, making it difficult to stick to the rule.

- It may not take into account individual circumstances: The rule does not take into account factors such as student loan debt, medical expenses, or a change in income.

- It may be too restrictive: For some people, the rule may be too restrictive and may not allow for enough discretionary spending, leading to feelings of deprivation or making it difficult to stick to the budget.

- It may not be flexible: The rule doesn’t take into account unexpected expenses that may arise, making it difficult to adjust the budget.

- It may not be inclusive: The rule may not be inclusive of certain lifestyle choices or communities, such as single-parent households or low-income families, making it difficult to apply the rule to their specific circumstances.

It’s important to remember that the 50/30/20 rule is just a guideline and may not work for everyone. It’s important to assess your own individual financial situation and create a budget that works for you.

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of income towards necessities, 30% towards discretionary spending, and 20% towards savings or paying off debt. This rule can be applied by anyone looking to create a budget and manage their finances. It is a simple way to ensure that expenses are kept in check and that a person is able to save and invest for the future.